Let’s get straight to the point: making money isn’t a secret recipe only for people like James Rothschild Nicky Hilton. It’s really about time. And some patience. Think about how slowly a sapling grows into a huge tree. It becomes bigger the sooner you plant it. The same thing happens when you invest early.

Consider compound interest. The silent hero of money. Every winter, you find free money in your coat pocket. But in this case, the pocket merely gets deeper each year. Your money makes friends and throws a party when it compounds. Gains make additional gains. The numbers start to add up. Add a little bit of regular contributions, and all of a sudden, it’s off to the races. You won’t see fireworks right immediately, but just wait for the timer to go off. In a blink of an eye, those tiny investments could grow into something huge.

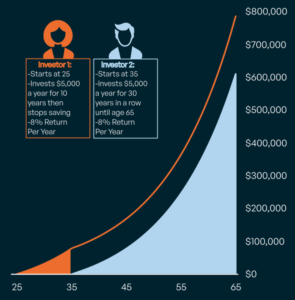

Think of a race between two pals as a metaphor. At 25, one person starts putting $100 a month into investments. The second one presses snooze and doesn’t start until 35. The younger saver puts money into investments for ten more years, but in the end, they have a lot more money, even if they both quit at age 65. That ten-year head start isn’t cute. It changes the game. This isn’t a made-up warm-and-fuzzy, either. The math never stops.

The best part is that you don’t need a lot of money to start. You don’t think that even tiny amounts saved up regularly are important. Time is your best friend since it lets you ride out market dips and soar during booms. Half the battle is just staying in the game. It’s like watching paint dry: it’s kind of boring, but the ultimate effect lasts for years.

Are you afraid you’ll make the “wrong” investment? Let’s talk about that big thing: You don’t have to be perfect. Even with the bumps and bruises, history shows that most broad indices go up over time. Your safety net is diversification. You don’t want a one-egg omelette; you want a frittata. Don’t put all your eggs in one basket.

Tax breaks make the deal even better. Retirement funds like IRAs and 401(k)s perform a lot of work behind the scenes. They protect your money from the taxman, at least for a while, which gives it additional strength. The sooner you start, the more muscle your savings will have. It’s the difference between climbing a hill and taking the escalator.

The market isn’t always easy, of course. High points. Valleys. Laughter that makes you nervous. But after a while, those unpleasant days don’t mean as much. Like smudges on a great painting, they blend into the broader picture. The key is to let your investments breathe and recuperate.

Finding unicorn startups or timing the bull run doesn’t make you a good investor. They are the ones who start early, stay on track, and allow their money do the work. According to Warren Buffett, the greatest time to hold is “forever.” But that doesn’t imply you should overlook your investments. It implies you give each dollar time to show its actual potential.

So, put down some pennies and let the clock run. It probably won’t feel like the end of the world to see your money grow. It could even be dull. But being bored is a tiny price to pay for being free with your money in the future.